tax saving tips for high income earners uk

Our tax receipt scanner app will scan. Tax saving tips for high income earners uk Monday March 14 2022 Edit.

10 Ways To Reduce Your Tax Bill Frazer James Financial Advisers

As a high-income earner you may feel comfortable about your ability to cover out-of-pocket medical costs.

. The more you make the more taxes play a role in financial decision-making. One of the most effective ways for high earners in the UK to build wealth tax-efficiently is to save into a pension. Ad Browse Discover Thousands of Law Book Titles for Less.

A Solo 401k can be the single most valuable strategy among all the tax saving strategies for high income earners. Ad Explore Key Insights Investment Tips Strategies From Respected Investors. Your Slice of the Market Done Your Way.

The annual pension allowance of 40000 is restricted for high earners such that for individuals with income over 240000 the allowance is restricted by 1 for every 2 of. In fact Bonsai Tax can help. Dont discount the wealth-generating potential and flexibility an HSA can afford.

The total contribution limit for a 401 k plan in 2021 is 58000 plus an additional 6500 for those 50 and older or 100 percent of an employees compensation whichever is. Find Helpful Tips Along The Way Like Which Debts to Pay First and How Much To Pay. We will begin by looking at the tax laws applicable to high-income earners.

Most high income earners lose the ability to take many tax deductions because the tax laws are tilted so unfairly toward them contrary to popular opinion. Another one of the best tax reduction strategies for high-income earners is to contribute to a retirement account. A great tax saving strategy for self-employed high income earners is to record and track all of your business expenses.

Max Out Your Retirement Account. High Income Earners Fail To Appreciate The Math Of 529 Plans Part Ii Resource Planning Group 529. Ad With a Few Steps The Tool Could Help You Make a Plan Based on Your Budget.

Within a pension capital gains and dividend income are. Join Hosts Katie Koch And Alison Mass. Ad With a Few Steps The Tool Could Help You Make a Plan Based on Your Budget.

For example if you earn 100000 and receive a bonus of. Find Helpful Tips Along The Way Like Which Debts to Pay First and How Much To Pay. In this post were breaking down five tax-savings strategies that can help you keep more money in.

A Solo 401k for your business delivers major opportunities for huge tax. Want To Learn More About Investing. This bracket applies to single filers with taxable income in excess of 539900 and married couples filing jointly with taxable income in excess of 647850.

An overview of the tax rules for high-income earners. This is known as the 60 tax trap as you effectively pay tax at the rate of 60 on income between 100000 125000. As tax allowances are progressively withdrawn on any income over 100000 there is also a marginal effective rate of c60 that applies to any income between 100000 and 125000.

High-income earners make 170050 per year.

Not All Taxes On The Rich Are Created Equal Tax Policy Center

529 Ira Roth Ira Hierarchy For Tax Savings Michael Kitces Financial Planning Savings Strategy Financial Planning Hierarchy

Why It Matters In Paying Taxes Doing Business World Bank Group

W9 Form Page 9 Why W9 Form Page 9 Had Been So Popular Till Now Changing Jobs Going Crazy Starting A New Job

Biden Would Raise Taxes Substantially For High Income Households But Cut Taxes For Families With Children Tpc Reports

Pin On Best Of The Millennial Budget

Good Simple Advice Get The Basics Right And The Rest Will Be Easier Accounting Humor Tax Quote Tax Season Humor

Build Back Better 2 0 Still Raises Taxes For High Income Households And Reduces Them For Others

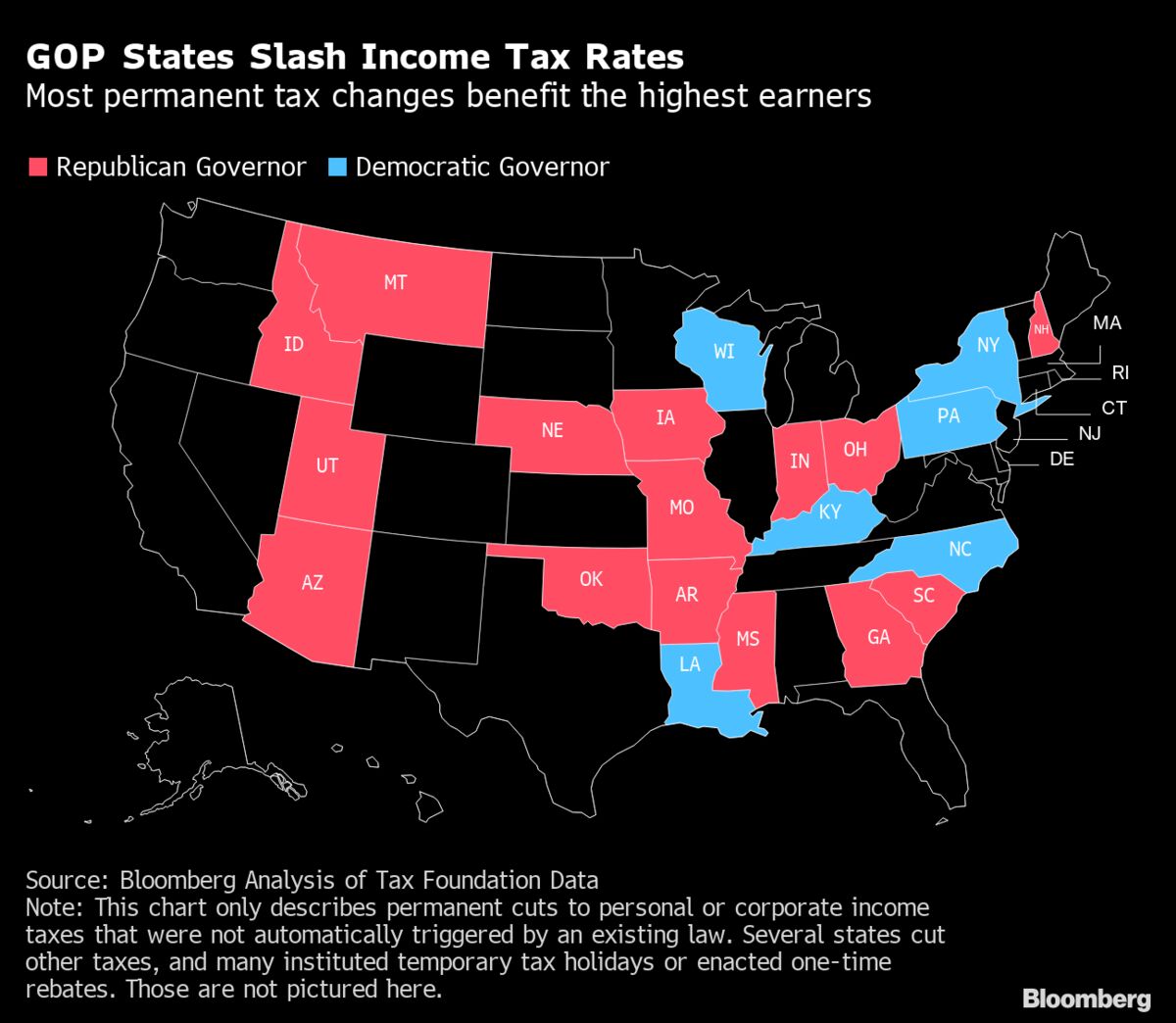

State Income Tax Rates Highest Lowest 2021 Changes

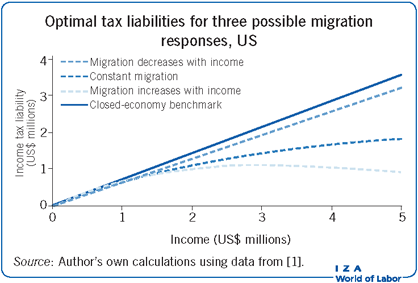

Iza World Of Labor Is High Skilled Migration Harmful To Tax Systems Progressivity

How To Do Backdoor Roth Ira Roth Ira Roth Ira Contributions Finance

10 Tax Reforms For Economic Growth And Opportunity Tax Foundation

Free Childcare In Scotland How To Guide Childcare Childcare Costs Early Learning

18 Ways To Reduce Your Taxes The Motley Fool

Us States Slash Taxes Most In Decades On Big Budget Surpluses Bloomberg

Tax Strategies For High Income Earners 2022 Youtube

How Fortune 500 Companies Avoid Paying Income Tax

Tax Evasion Among The Rich More Widespread Than Previously Thought The Washington Post